The Guardian has picked up a story from some figures produced by the insurance giant Allianz Trade, showing the import checks due to start in less than three weeks will add about £2 bn in the first year to Britain’s imports of plant and animal products. This is apparently about 10% of the value and is set to increase inflation by 0.2%. Coincidentally, the government has also announced the suspension of tariffs on 126 types of goods that we don’t produce or produce enough of in this country. This is claimed by Allianz to cut import costs by £7bn although the report isn’t clear if this is per year or for the whole of the temporary period up until 2026. I suspect it’s the latter.

Trade minister Greg Hands tweeted the news with a nice graphic:

Tariff Suspensions!Businesses across a range of sectors including chemicals, automotive, and food & drink will now benefit from lower tariffs.We heard from over 200 businesses and we delivered✅Another great example of how @biztradegovuk is addressing pressures on UK firms. pic.twitter.com/oEXBOSCRGz— Greg Hands (@GregHands) April 11, 2024

This doesn’t actually appear on the Business department website and the Twitter post from Hands doesn’t mention the £7bn. I find this a bit suspicious. They aren’t usually slow at coming forward and any straws within grasp are fair game. Cutting import costs by £7bn a year would be something.

Some Brexiteers have picked this up and are waving it about as some great victory. However, if I look at the Business Department website on tariff suspension I can see this is a process that goes back at least to 2012 when we were still members of the EU.

And a bit more research shows the EU also has a list of tariff and duty suspensions.

I haven’t compared the two current lists and I’m sure the UK will be suspending tariffs on different items to the EU but the principle is the same. If there are temporary issues with getting supplies of something or other it makes sense to cut tariffs.

It follows (I think) that if we were still members of the EU either there wouldn’t be shortages or we would be able to get the EU to suspend tariffs and we would get the same benefit so I'm not convinced this is a real 'benefit' of Brexit, not least because the suspension of tariffs is only temporary, not permanent. The £2bn a year in costs for the import checks starting at the end of this month are permanent.

I assume suspensions are not permanent because they risk damaging our own industries that may be trying to compete and are useful bargaining chips in any new trade talks. It will almost certainly increase the already worrying and growing trade (balance of payments) deficit by increasing imports.

On the £2bn a year being added to imported food The Daily Express describes that as a "Brexit hammer blow tax." You sometimes wonder what its readers think. One day Brexit Britain is hailed as a great success story, the next it's being 'hammered' by the same event. They must be punchdrunk by now.

On the news that the UK somehow 'surged' past France, Japan, and the Netherlands in 2022 to become the world's 4th biggest exporter I have been wrestling with the UNCTAD website from where the figures came and it's clear there has been no 'surge' at all. We have been swapping places with France for years, the differences usually being very small. Sometimes they're ahead and sometimes we are.

But France has a smaller working population of 29.8 million compared to our 31.8 million.

The Netherlands was miles behind in 2016 ($656bn to our $775bn) but by 2022 they were snapping at our heels ($1,004bn to our $1,015bn) and in 2023 they actually overtook us ($1,251 to our $1,104) as we slipped back:

Have to laugh, don't you? Just when #Brexitards have been celebrating UK showing up as 4th in the list of top exporters, UNCTAD releases preliminary data for 2023, showing that UK is again below the Netherlands, 5th in the table. 🤣 #UKGoodNews #Brexit— Andy Squibb (@squibbmeisteruk.bsky.social) (@SquibbmeisterUK) April 11, 2024

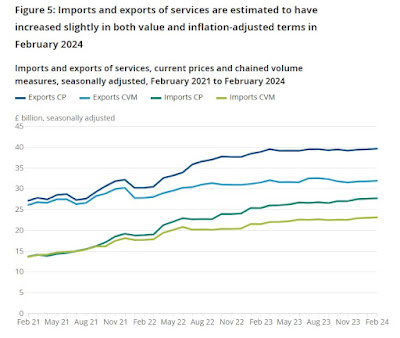

You can see this in the latest ONS figures published in February. Note the quantity of services exports adjusted for inflation (CVM) barely grew at all last year while imports of services grew more strongly and reduced the surplus we usually have in services. The ONS says, "the trade in services surplus is also estimated to have narrowed by £1.6 billion to £35.7 billion."

There is zero evidence of any great 'surge' in the UK's export performance in services as can be seen from the chart above. We know - and Brexiteers seem to accept - that trade in goods has suffered and now it seems services trade is being affected.

And finally, the think tank UK in a Changing Europe has published the latest divergence tracker which once again shows how the government is still tinkering at the edges with minor alterations to Retained EU law. There is no appetite for the wholesale scrapping of EU regulations that both Truss and Sunak pledged in 2022 during the Tory leadership election.

The biggest differences have come from the UK not implementing new EU laws:

"In the Q1 2024 edition, the tracker finds five cases of active divergence (where the UK, or some part of it, changes its rules); fifteen of passive divergence (where the EU changes its rules and the UK, or some part of it, does not follow); one of ‘NI divergence’ (a new category covering cases where action is taken on the potential application of new or updated EU legislation in Northern Ireland); one of procedural divergence (where new processes are introduced to change how pre-existing divergence is managed); and three of active alignment (where the UK takes steps to align more closely with EU rules, systems or programmes)."

A briefing note from UKICE notes that "Many of the [New EU] rules will de facto apply in the UK too, as they apply equally to 'third country' businesses -including British ones - who want to sell into the EU single market."

This is the Brussels effect and shows how little 'control' we have actually taken back.